Batteries for the World

The Battery Revolution

Batteries are becoming the cornerstone of our modern world. They power our present and will shape our future. From the battlefields of Ukraine, where drones are revolutionizing warfare, to the streets of our cities, where electric vehicles promise a cleaner tomorrow, batteries are everywhere.

Their impact extends far beyond mobility. They are the silent enablers of our digital age, powering the devices that connect us. They are the key to unlocking renewable energy's full potential, storing solar power for when we need it most. In essence, batteries are transforming how we generate, store, and use energy.

Like the steam engine that powered the Industrial Revolution or the internal combustion engine that shaped the 20th century, battery technology - together with Solar - will usher in a new era. It's enabling us to convert abundant materials into powerful, portable energy.

Europe's Current Position

The industrial capacity to produce batteries is an enabler and value-creator. Here is Ed Conway in Material World: "And what does this spell for our economies and our industrial fabric? Think about it: in a petrol car, the single most valuable component is the internal combustion engine. Part of the reason the car industry has remained one of the last great redoubts for high-skilled, high-paid manufacturing in Europe, Japan and the US is that these carmakers still largely make their own engines. Part of the reason car manufacture long remained dominated by these 'legacy' regions is that making engines is hard. But if the past century was all about pistons and aprons covered in oil, the next one will be all about test tubes, cleanrooms and hazmat suits and understanding the electrochemical reactions occurring inside seemingly inert cells. Suddenly things start to look very different: in an electric car the battery, not the engine, is the most valuable component."

But to produce batteries, you need processed materials: "A typical electric car battery contains about 40kg of lithium, alongside 10kg of cobalt, 10kg of manganese and 40kg of nickel". And at the moment, Europe does not produce anywhere near enough of those; it relies heavily on Chinese imports for both batteries and materials. This dependency needs to change.

The Solar Connection

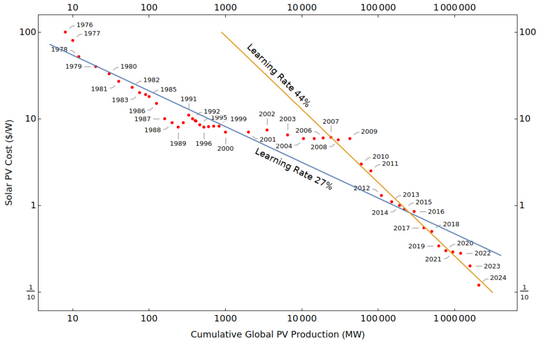

The case for European battery materials production starts with solar energy. Unlike nuclear power, which has faced significant challenges in cost reduction (actually, they have even been increasing in last decades), solar has been a remarkable success story. The technology has followed a consistent learning curve, with costs decreasing by approximately 20% for every doubling of cumulative production. This trend has held steady for decades and continues today.

The cost of solar decreases as we produce more. From Casey Handmer

Solar is easily deployable and scalable. It does not take anywhere near as many permissions as does building a reactor. But, to be a reliable source for our grid, it needs batteries. And lots of them. Batteries are how we store energy, and thus the critical link to applicability.

The Path Forward

The European Union has recognized the need for more diverse supply chains of critical raw materials. In March 2024, it adopted the European Critical Raw Materials Act, explained here, which sets clear targets for 2030:

- Domestic Production: Extract at least 10% of the EU's annual needs

- Processing Capacity: Process at least 40% of the EU's annual needs

- Recycling Goals: Recycle at least 25% of the EU's annual needs

- Diversification: No more than 65% of EU's annual needs of each strategic raw material should come from a single third country

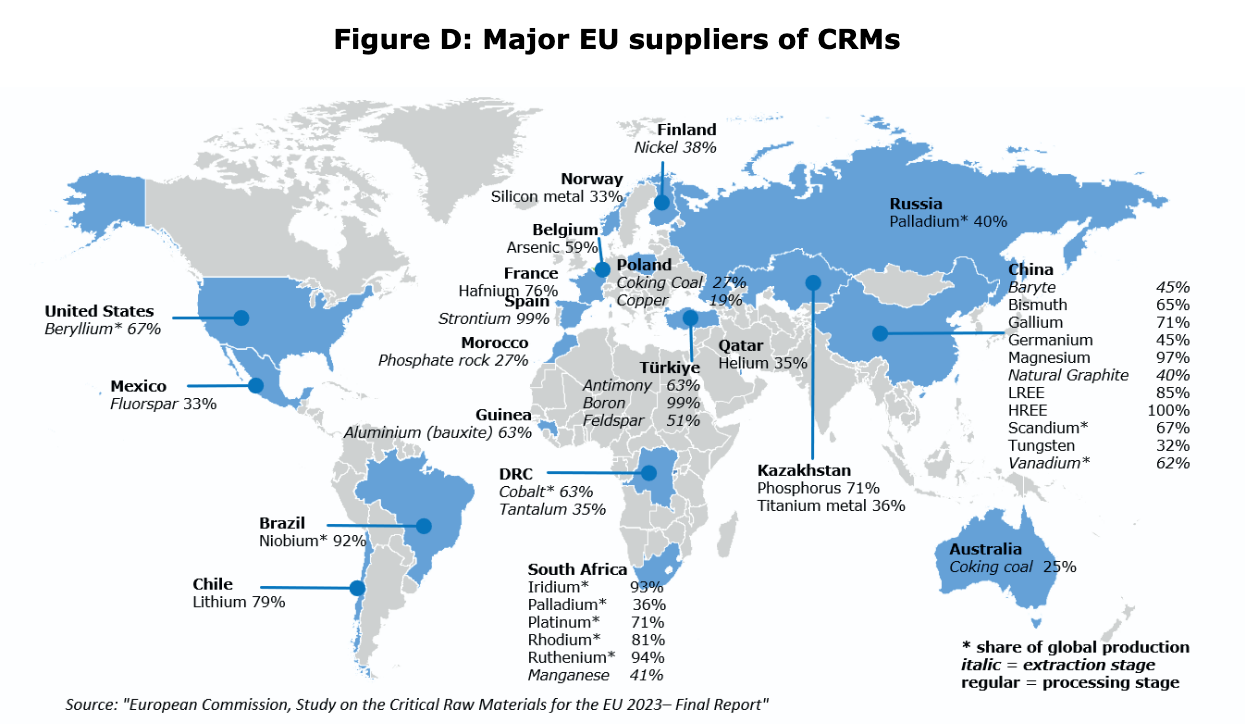

These are ambitious goals. The map below shows where the EU got its critical raw materials from in 2023. It shows that we are far from the Diversification Goals of 2030. China, for example, currently provides 100% of the EU's supply of heavy rare earth elements.

Major EU suppliers of CRMs. From here

Why recycle: The Steel Example

The path forward requires both new extraction + processing and recycling. I think that recycling is a special opportunity for Europe.

The example of Steel is illustrative. In the industrial age, Europe and the United States started to mass-produce Steel. The economy and labor market advanced, and GDP rose. In its rise, much of the refinery moved to China - in fact, they bought whole plants and transported them step by step to their homeland and rebuilt them there. China acquired this technology, and is now the biggest in processing materials and in producing actual steel. The United States, on the other hand, have an Overall Steel Recycling Rate between 70 and 80 percent, and Europe has one above 50 percent.

The point is: Yes, we need a lot of new steel each year. But we also already have a lot of steel around, that we do not need anymore each year. Thus, we don't have to dig as much new iron from the ground anymore, because we can instead recycle the one we use already.

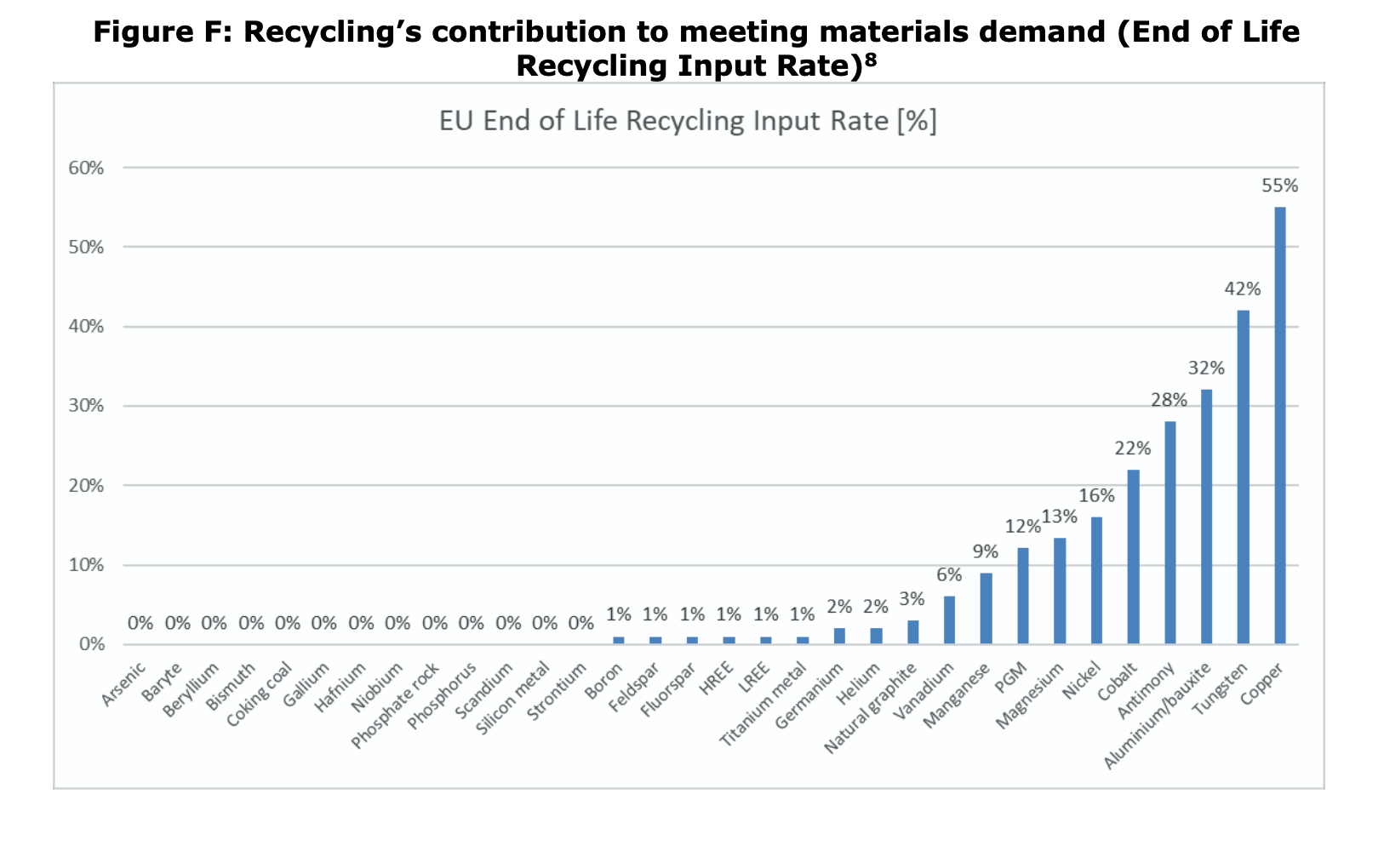

Contrast that with most other Materials:

Recycling Rates for different Materials. From here

For many of these materials, we recycle close to zero. Of course, they are different from steel: They require different recycling technology. They are needed in far smaller amounts, and the way that they are being used makes them harder to isolate and recycle at their end of life. But if we want to take sustainability and circular economy seriously, we must and will find ways to increase recycling for all of these.

The Opportunity

The challenges we face are significant, but so are the opportunities. The EU's ambitious targets, combined with the growing demand for battery materials, create a perfect storm for innovation and industrial transformation. This isn't just about catching up with China—it's about creating a new, sustainable model for materials production and recycling.

While automakers could be seen as poised to lead and push for this change, they have not. They are heavy machinery built on the combustion engine. A switch would not be just something, it would be a change of identity. This is unfortunate, because as we can see internationally in the examples of Tesla and BYD, they are key drivers of supply chains and a bunch of supporting industries.

Who, then, will pick up the shovel? Startups that invest in technology and are not on any path-dependency yet. I hope to contribute to one such start-up.

Summary

The situation can be summed up in three key points:

- Europe needs to become autonomous in Energy and Technology

- Europe wants to reduce carbon emissions and introduce more circular economy

- Batteries are a key technology for both aspects

The extraction and processing of raw materials is the foundation for all industry. In the long term, recycling will become more important: Once we have mined enough raw materials, we should make sure to not throw them away, but to always reuse them. We have not yet figured out how to do this efficiently. Whoever does so first, will not only secure a competitive advantage but also help shape the future of sustainable industry in Europe.

More

Some startups I stumbled upon along my research:

- Prometheus fuels

- Magrathea

- Terraform

- updated 13.10.2025: Carester, or rather is subsidiary Caremag SAS, is doing exactly what I thought about when writing this post. They are a European champion. They are building a plant in France, that is planned to be operational in late 2026 and would boost European independence, which becomes more critical with every escalation in the global geopolitical situation.

And more ...

- here a nice article on the recycling rare earth elements and what the current problem is.

- McKinsey article: The battery cell component opportunity in Europe and North America

- A great newsletter on China and Industry: High-Capacity

- How Batteries Are Making the Electrical Grid More Reliable